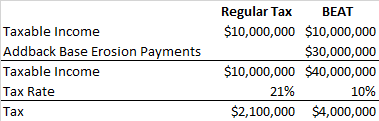

Just BEAT It' Do firms reclassify costs to avoid the base erosion and anti-abuse tax (BEAT) of the TCJA? – UNC Tax Center

The Base Erosion and Anti-Abuse Tax (BEAT) Final and Proposed Regulations Issued by Treasury and the IRS in December 2019 – Application to Partnerships - True Partners Consulting

Jackson Hewitt Tax Service - With less than a month to October 15, beat the deadline by filing with an Expert Tax Pro! If you already filed, make sure you got every

Beat Estate Tax Forever : The Unprecedented $5 Million Opportunity in 2012 - Walmart.com - Walmart.com